After yesterday saw marketplaces around the world take on more of a risk off mentality, today is significantly quieter and calmer. With China taking the day off and the Nikkei Index only moving a little bit, one of the most volatile parts of the world has decreased its volatility, at least for now. We discuss emerging market trends while also touching on European news that, for once, was not shrouded in negativity and harsh speculation.

Calmer World Markets

After yesterday saw investors around the world take on more of a risk-off mentality, things got pretty crazy for much of the day. While the mentality is still the same, for the most part, things have calmed down significantly. European stock markets hovered around near-normal levels while some good economic news was reported from the region for the first time in quite a while. From March to April, industrial production across the euro zone rose by just shy of half of a percentage point.

There are some people who believe that this news is indicative of a recovering European economy, but I am not one of those people. This is one isolated bit of good news out of Europe, when most of the news we have been hearing out of the region lately has been nothing but negative. Maybe if a few more weeks of strong stock market runs and better economic news is witnessed then we can start talking about an improving European economy.

Trending Activities

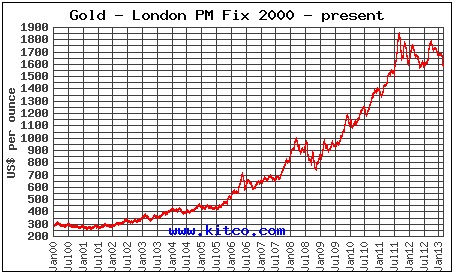

Over the course of the past few days we have been witnessing marketplace trends from all across the world. These particular activities have been noticed by a lot of people, but are and should be particularly interesting to precious metals investors.

Bond yields in many parts of the globe have been on the rise. Yesterday we saw Greek bond yields top 10% while today we saw a German government bond auction yield its highest numbers since this past February. It isn’t only Europe who is seeing this kind of activity either, as US Treasury bonds have hit multi-month highs very recently too.

Another activity we have seen is the widespread dumping of mid-level currencies from emerging markets in places like Thailand, India, and Malaysia. This may not seem like big news because we aren’t talking about the Yen, Euro, or USD, but if people begin letting go of currency investments, we could see it have positive impact on precious metals.

Rounding out the Week

There are no major headlining economic reports or announcements coming up in the next 2 days, so it is expected to be a quiet end to the week. With marketplaces around the world not doing much moving on Wednesday and zero big news stories coming up, a slow end of the week looks all but guaranteed.

With that being said, it must not be forgotten that markets love to surprise at the end of the week, so it is always important to stay tuned in.