Gold and silver are both feeling heavy selling pressure through midday on Wednesday as a result of remarks made by both Janet Yellen and Vladimir Putin. Tensions in Ukraine are still extremely high, but president Putin’s remarks may have shed some light on how the situation will be brought to an end.

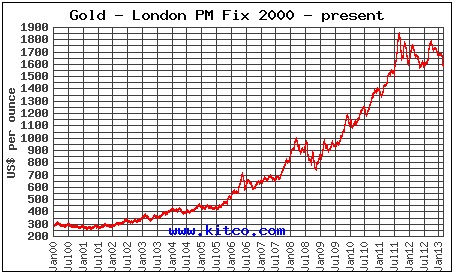

As it stands, gold is well below the $1,300 threshold while silver is suffering so much so that it is approaching $19/ounce. If the rest of the week pans out how most investors are expecting it to, with little economic data to talk about, it is likely that precious metals will continue to feel strong selling pressures.

Remarks By Putin, Yellen Do Their Best To Derail Metals

The crisis in Ukraine has been in and out of the headlines for the better part of two months now and the violence and unrest seems like it will never be brought to an end. Just this past weekend reports streamed in claiming that the Ukrainian military was advancing on pro-Russian rebels who have taken up positions throughout Ukraine’s eastern and southern regions. Since these operations commenced less than a week ago, the death toll is in the multiple dozens and is only growing.

Today, however, the world may have gotten its first glimpse at how the violence in Ukraine will be put to an end. In a public speech, Vladimir Putin said that he is willing to discuss possible peaceful ends to the violence and that pro-Russian forces in Ukraine’s east should postpone a vote that would, in essence, give another large part of Ukraine to Russia. It is still too early to tell if Putin really means the words he spoke today, but the market seems to already believe him as safe-haven demand for precious metals took a considerable hit earlier this morning.

Also working against precious metals today was a speech made by president of the Federal Reserve, Janet Yellen, to the Congressional Joint Economic Committee. In her remarks she made it clear that her and the rest of the Fed think the US economy is growing in strength and has nowhere to go but up throughout the remaining 7 or so months of the year. She also stated that interest rates will have to remain low for a “considerable time”, a remark that flies directly in the face of the widely held opinion that interest rates were going to be risen by Spring of 2015. In all, gold has fallen by almost a whole percentage point today and is continuing to feel selling pressure as we head towards the day’s end. If the week carries on and few new inputs make their way to the marketplace it is very likely that gold and silver spot values will fall even further than they have already.