After hitting a 4+ month high in the early morning hours, gold took a downward turn not too long after markets had opened in the US. The downturn in the spot value of gold and silver is being largely attributed to profit-taking in the wake of what has been a stellar run by precious metals. Civil unrest around the world is continuing to keep safe-haven demand on the up and up, though there is no saying how long safe-haven demand alone will be able to keep gold and silver above key resistance levels.

A strong batch of US economic data released today also likely put downward pressure on metals. As of late, however, most pieces of US economic data have been far from upbeat.

Mixed-Bag of Factors Pushing Metals In All Directions

Over the last week or so, precious metals investors have seen a number of new factors enter the marketplace, all of which standing the chance to move the spot values of gold and/or silver. For one, the civil unrest still raging in Ukraine has helped fuel safe-haven demand for metals, which is at its highest point in months. While Ukrainians have been vehemently protesting their now ex-president’s decision to cut ties with the EU in exchange for a hefty financial bailout from Russia for months now, the protests only began turning extremely violent early last week. Since then, the death toll has exceeded 100 and is still climbing. Though ex-president Yanukovych is now fleeing authorities, the situation in Ukraine is far from solved. As the unrest carries on, investors can expect that safe-haven demand for gold and silver will too. Ukraine is not the only part of the world seeing civil unrest either, as Thailand is experiencing much of the same. Though the violence in Thailand has been less severe than in Ukraine, there remains a constant threat that things can boil over at any minute.

In other news from around the world, an economic report out of the US with regard to housing sales has caused risk-aversion by investors to be put to a halt, at least for now. The report stated that new home sales rose at their fastest pace in more than 5 years. Rising by nearly 10% an annual basis, new home sales in the US grew by a significant margin that handily beat the expectations of the market. Naturally, upbeat US economy data such as this report worked against the prospects of gold and silver, pushing both metals downward for almost the whole day on Wednesday.

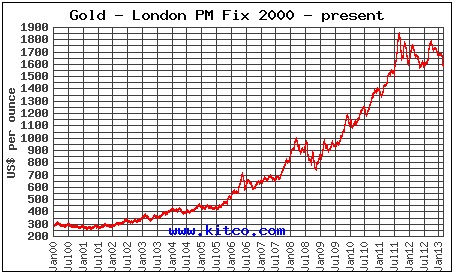

Despite today’s losses by metals, both gold and silver are still in a decent position, with gold well over the crucial $1,300 threshold and silver hovering in between $21 and $22/ounce. As we head further into 2014, it will be interesting to see if gold and silver can hang on to gains made over the past few weeks or if profit-taking and other factors will drive the values down once more.