Gold and silver are posting modest gains for a third consecutive day, even in light of an increase in risk-appetite. Due to a lack of fresh US economic data, the marketplace is still digesting Janet Yellen’s first address to Congress as head of the Federal Reserve which took place a day ago. Though Yellen did not offer much in the way of insight as to the Fed’s future monetary policy decisions, her remarks made it clear that she is none too different than her predecessor, Ben Bernanke. Something that did help gold, however, was the fact that both Yellen and St. Louis Federal Reserve president James Bullard made it clear that the Fed is in no rush to take QE away entirely.

This week is already shaping up to be a quiet one as far as economic data is concerned, the only real report to talk about will be Thursday’s weekly jobless claims report, though this is not likely to have any big impact on precious metals spot values.

Safe-Haven Demand Given New Life

In light of a few recent factors, the demand for gold and silver has been on a consistent climb. For one, fears over the strength of emerging market currencies have caused thousands of investors to rethink putting their faith in assets like the Turkish lira and the Indian rupee. Though these currencies have since balanced themselves, investors remain wary.

Another factor currently aiding precious metals is a rough patch of both US and Chinese economic data. Over the course of the past month or so, the market has been greeted with few positive pieces of economic data from the world’s top 2 economies. In the US, monthly employment reports have disappointed for two consecutive months, while in China manufacturing data has been weaker than what we have grown accustomed to. Poor Chinese economic performance is hurting the industrial demand for gold and silver, though much of that vacant demand is being filled up by safe-haven investments. On the other hand, poor economic performance in the US is almost always going to be good for precious metals. Rapidly declining stocks as well as a pressured USD are making the outlook on gold and silver seem increasingly upbeat.

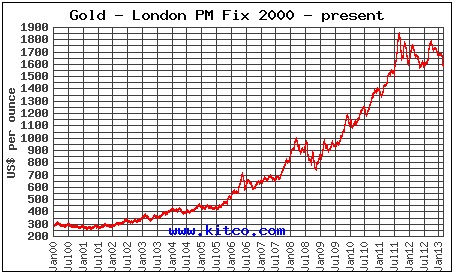

As it stands, gold is trading near a 3-month high and is continually inching closer to the $1,300 threshold.