Five gram gold bars are some of the most popular gold bars for small-time investors, and because of this they are also some of the most sought after gold bars overall as well.

If you are accustomed to investing in silver, 5 grams may seem like a small amount of metal, but the reality is that gold is much more expensive than silver per ounce, and even per gram. A good use for gold bars of this size is to add to a small investment or even to give this type of bar as a gift to someone who you think mny be thinking about investing in precious metals.

There are many places to buy gold bars such as brick and mortar dealers as well as online dealers, and knowing where to buy and who to buy from you may do yourself a few favors. In the following few sections we will discuss all the different things you need to know before investing in 5 gram gold bars.

Types of 5 Gram Gold Bars

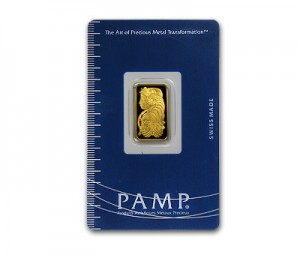

A 5 Gram Gold Bar from PAMP Suisse

As the size of gold bar gets larger, so too does the number of different companies that produce the bar. Unlike smaller bars such as 2 grams or 2.5 grams who only have one prevalent producer, prospective buyers of 5 gram gold bars have the luxury of choosing between a few different producers of the bars.

At first you may be surprised at the fact that the producer of the gold bar matters to customers, but brand loyalty is just as prominent in the purchase of gold bars as it is when people buy clothing and food.

The three main producers of 5 gram gold bars are Pamp Suisse from Switzerland as well as Credit Suisse, and Perth Mint from Australia. All three producers are world-renowned and trusted by traders everywhere so if you are a new producer you might find it a bit difficult to choose which company you like the best, but you can have comfort in the fact that no matter what you are getting a high quality gold bullion product.

Packaging

This whole article has been stressing that gold bars of 5 grams are not the smallest investment, but they are still small enough that you cannot just handle them outside of protection. For this reason nearly every 5 gram bar of gold you receive will likely be encased in plastic attached to a cardboard/plastic piece which certifies that the gold in the bar is actually gold and is not counterfeit.

This sort of encasement and certification is called an “assay”, and if you are purchasing a bar without it you are putting yourself at risk of receiving a fake product.

With that being said, there are still some 5 gram bars who are not encased in any plastic whatsoever that are perfectly legitimate. The only point that must be made about small gold bars not encased in plastic is that you must take good care of them because they are susceptible to being damaged and/or misplaced.

Premium Over Spot

When an investor who is new to the game hears the words “spot value” they are probably confused at first. All spot value means is the current market price of an ounce of gold. Because gold is traded and exchanges hands thousands and thousands of times every day, the value of the metal is changing as well. Sometimes gold goes up in value and sometimes down, but whatever the value of gold is at presently is the spot value.

Since gold dealers are in the business to make money, they cannot simply sell gold for the current spot value because they would never make money, they would simply be breaking even. Instead they add a premium, which is basically a fee on top of the spot value of the metal.

The size of your investment directly correlates with how much the premium will be, but typically you can expect 5 gram gold bars to have about a $20 premium. If it is anything over $25 you should strongly consider taking your business elsewhere.